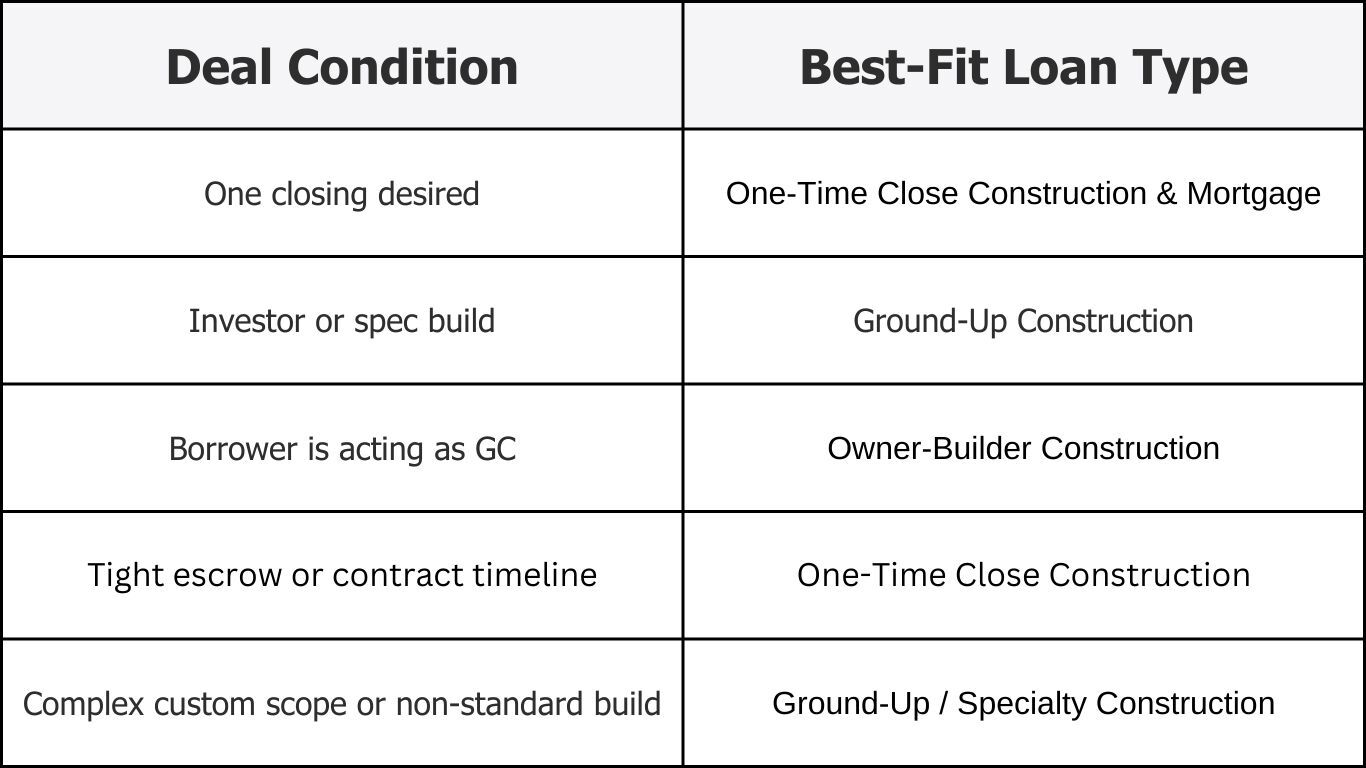

Construction-to-Permanent

-

One-time close construction & mortgage financing without locking permanent terms upfront

-

Flexible underwriting for complex or non-standard projects

-

Licensed general contractor required and approved prior to closing

-

Draw-based funding aligned to construction milestones

-

Clear exit flexibility (sale or refinance upon completion)

.jpg?width=1400&height=2000&name=Construction2%20Mortgage%20Loan%20Image%20(1).jpg)